Working Papers

The Effect of Centrally Bargained Wages on Firm Growth

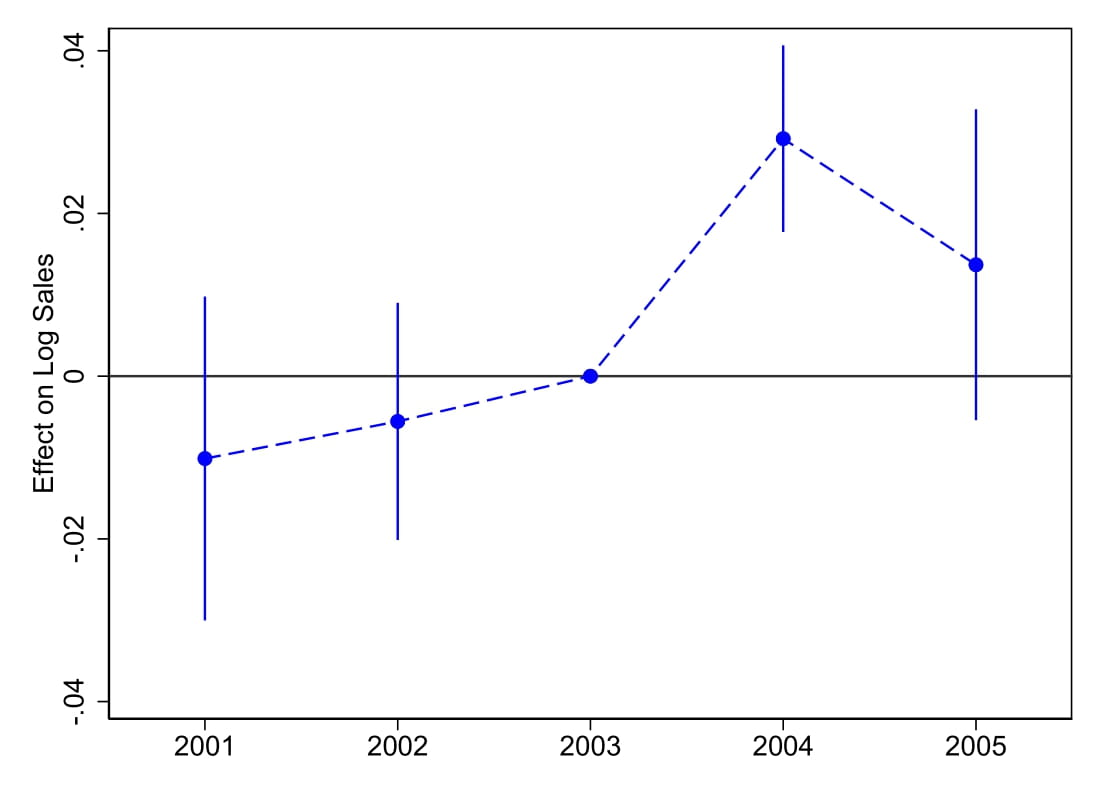

I study how firms adapt to exogenous changes in labor costs induced by collective bargaining agreements. I use data on collective bargaining agreements in Sweden and study the impact of the nationwide bargaining that took place in 2004. I make a difference-in-differences analysis and compare firms in the same industry that have a different initial skill composition of their workers and thus face different bargained wage increases. Higher centralized wage increases cause the average firm to increase average wages (1.3\%) and to grow faster (2.7\%) both in terms of employment and sales, while profitability decreases. Firms increase both investments and substitute low-skilled for high-skilled labor. Moreover, the effects are more pronounced for firms with more labor market power and easier access to external finance. This suggests that the results are affected by labor market power, and the ease of input factor substitution.

Media Coverage: Akavia Aspekt

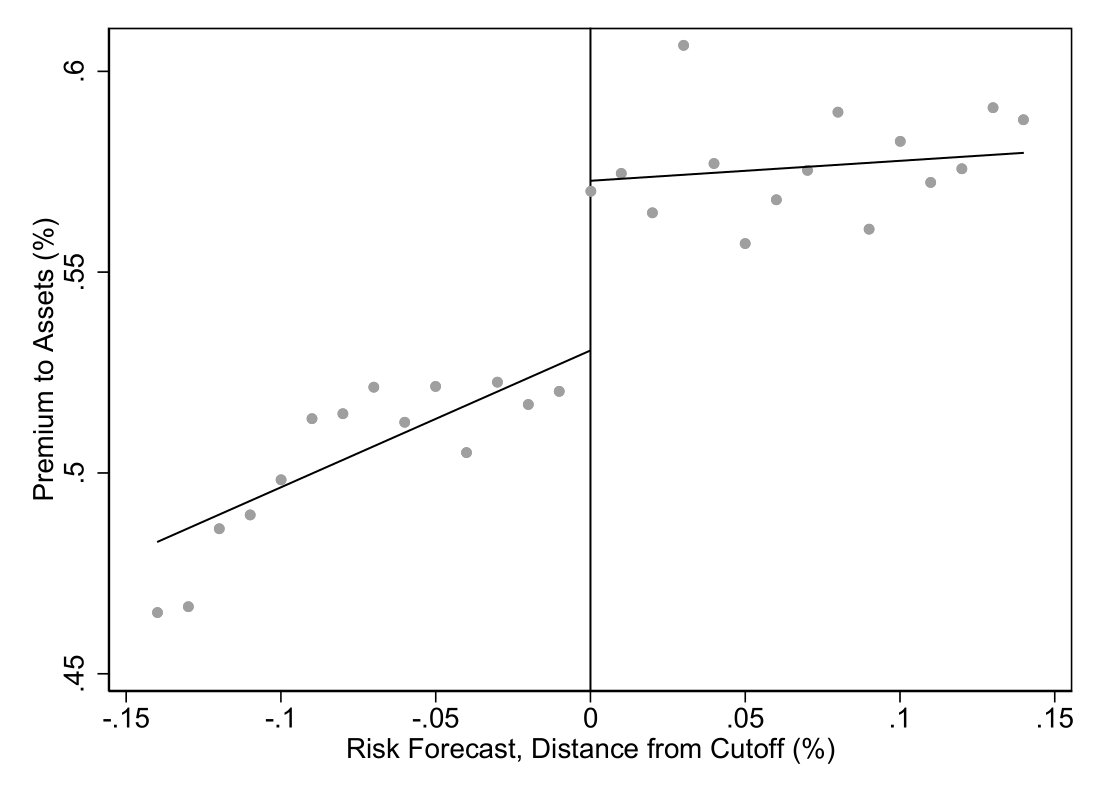

Financing Constraints and Risk Management: Evidence From Micro-Level Insurance Data

(with Oliver Engist, Gustav Martinsson and Christian Thomann)

We study the impact of financing constraints on corporate risk management. Using data on credit scores matched with unique information on firm level commercial insurance purchases, we find that financing constraints lead to higher insurance spending. We adopt a regression discontinuity design and show that financially constrained firms spend 5–14\% more on insurance than otherwise similar unconstrained firms. Our findings add new insights to the longstanding empirical puzzle whether financially constrained firms engage more in risk management. Furthermore, our results, shed light on risk management in smaller, mostly private firms.

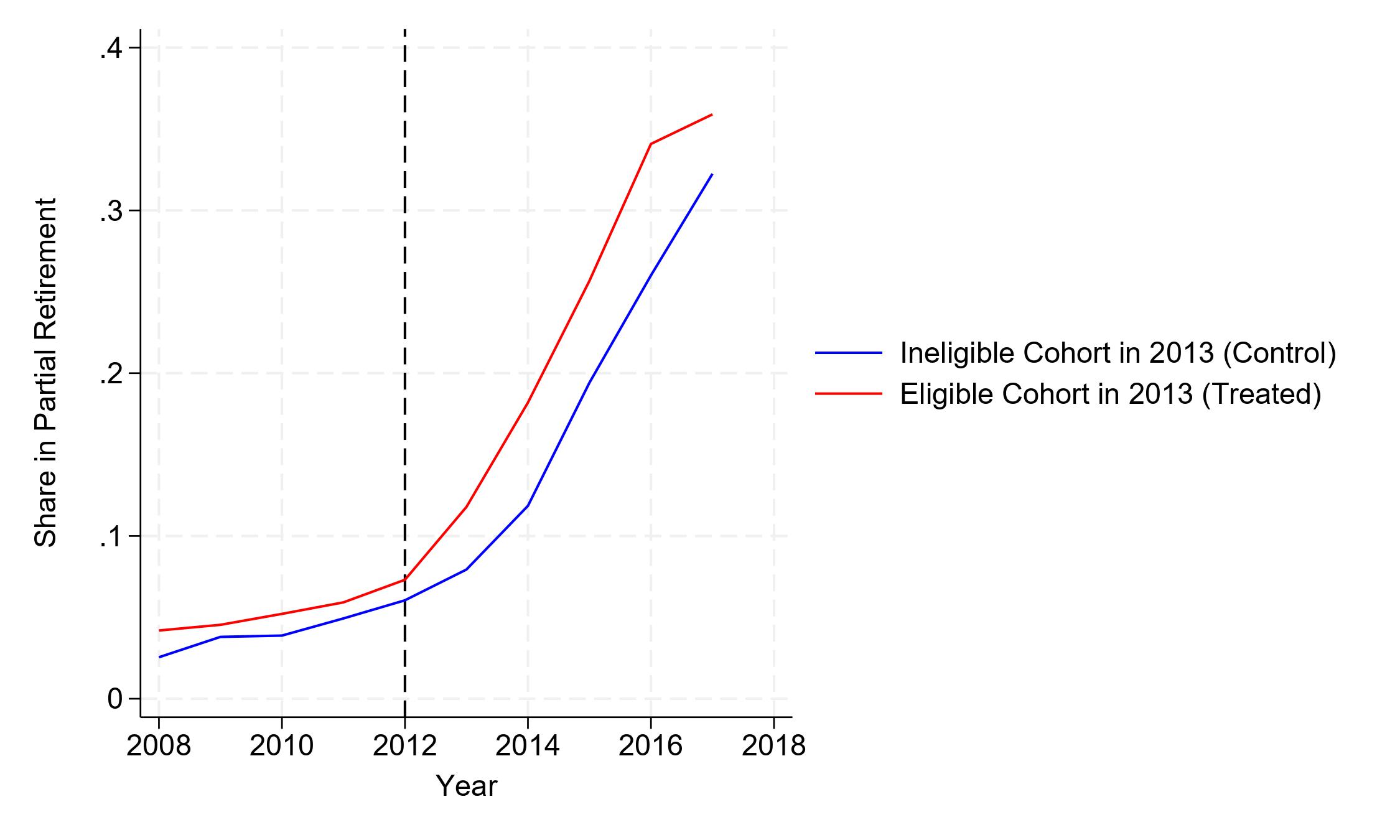

Partial Retirement and Labor Supply: Evidence from Swedish Collective Bargaining Agreements

Aging populations strain pension systems, prompting policymakers to introduce partial retirement schemes to incentivize workers to retire later. I study the impact of introducing partial retirement within collective bargaining agreements in Sweden’s manufacturing sector in 2013. Merging collective bargaining data with administrative records, I employ a difference-in-differences methodology to analyze the labor market trajectories of eligible and ineligible cohorts around the introduction year. The results reveal a nuanced picture: while eligible workers are more likely to work and claim pension benefits simultaneously, this comes at the expense of a 10% decline in employment rates and a SEK 50,000 reduction in labor earnings. In summary, partial retirement fails to extend working lives, thus undermining its utility as a one-size-fits-all solution to the future of pension systems.

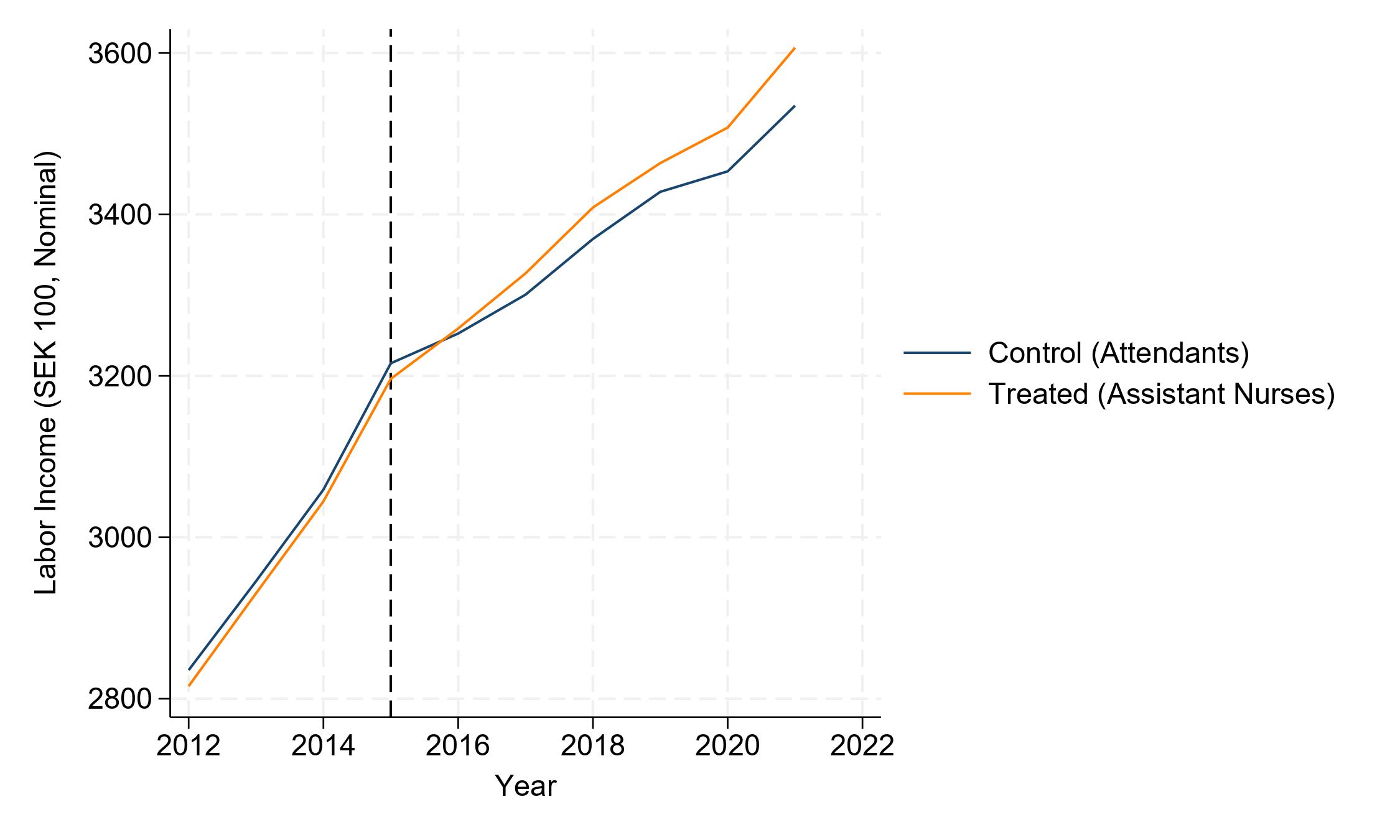

Collectively Bargained Wages and Female Earnings: Evidence from Swedish Local Governments

This paper studies how a special wage increase for assistant nurses in Sweden affected income and employment. Workers in the public sector receive wages based on negotiations between unions and employers. These agreements usually provide the same wage increase for all covered workers. In 2016, an agreement was reached in the local public sector to provide special wage increases for assistant nurses and regular increases for other workers. I study the effects of this agreement using administrative data on Swedish workers, covering their occupation, income, and collective bargaining coverage. I do a difference-in-differences analysis comparing assistant nurses and attendants covered by the same agreement. The two groups had similar employment and income levels before the agreement was reached. Assistant nurses see higher wage increases in the years following the agreement, peaking at SEK 8,700 (USD 870). In contrast, I find no robust effects on separation or working time.

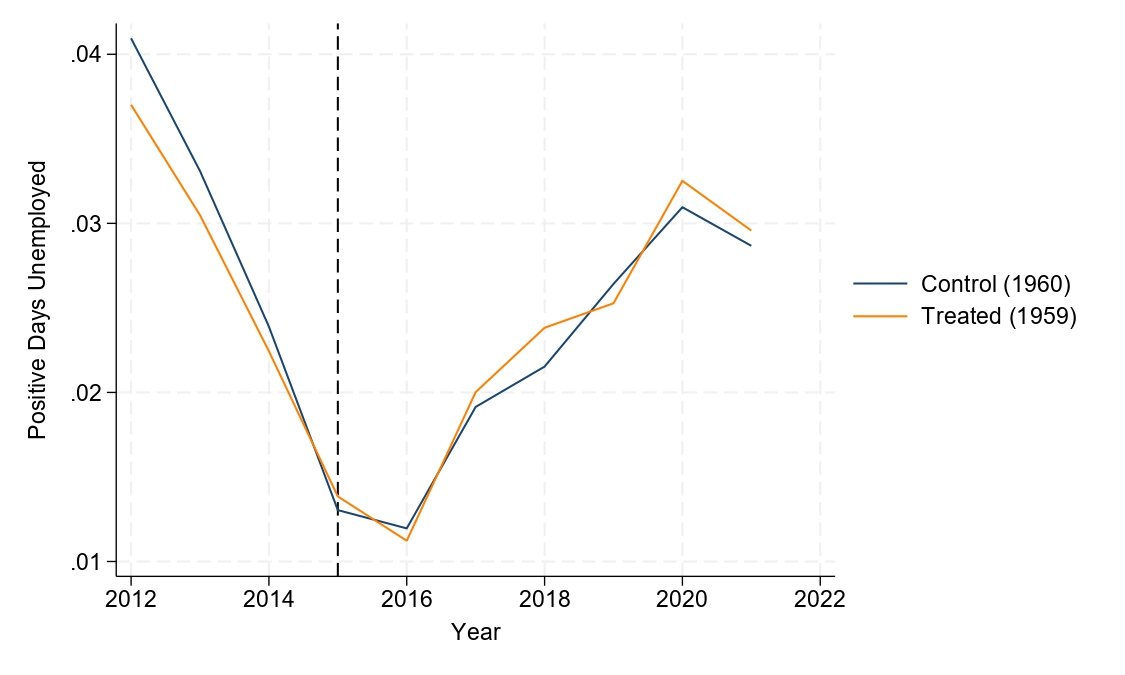

Mandatory Notice and Unemployment: Evidence from the Swedish Public Sector

I study the impact of mandatory layoff notice policy on employment trajectories in the Swedish local public sector. In theory, mandatory notice provides insurance against income risk by allowing workers to search before being laid off. However, there is little empirical evidence on the size of these effects. In Sweden, notice periods can be regulated by collective bargaining agreements. I study the effects of a change in 2016 that introduced a longer notice period for those aged 57 or above. I use administrative data to compare the evolution of workers who turned 57 in 2016 with those who turned 56 before and after the change. The results reveal no significant improvement in employment prospects for workers with extended notice periods. This finding contrasts with the existing literature, which primarily emphasizes the positive outcomes of mandatory notice in the private sector.

Financial Constraints and Cash Holdings in Private Firms: Evidence from Discontinuous Credit Ratings

(with Oliver Engist

Westudy how financing constraints affect the cash holdings of small and mediumsized enterprises. There has been little empirical work on this topic, even though these firms often face financial constraints. We contribute by using detailed data on credit ratings in Sweden as a measure of financial constraints. We then use panel regressions and a regression-discontinuity analysis to estimate the relationship between access to credit and cash holdings. Our analysis finds no causal effect of credit ratings on cash holdings.

How Well do Firms Recover from Idiosyncratic Shocks? Evidence from Insurance Claims

(with Oliver Engist and Christian Thomann)

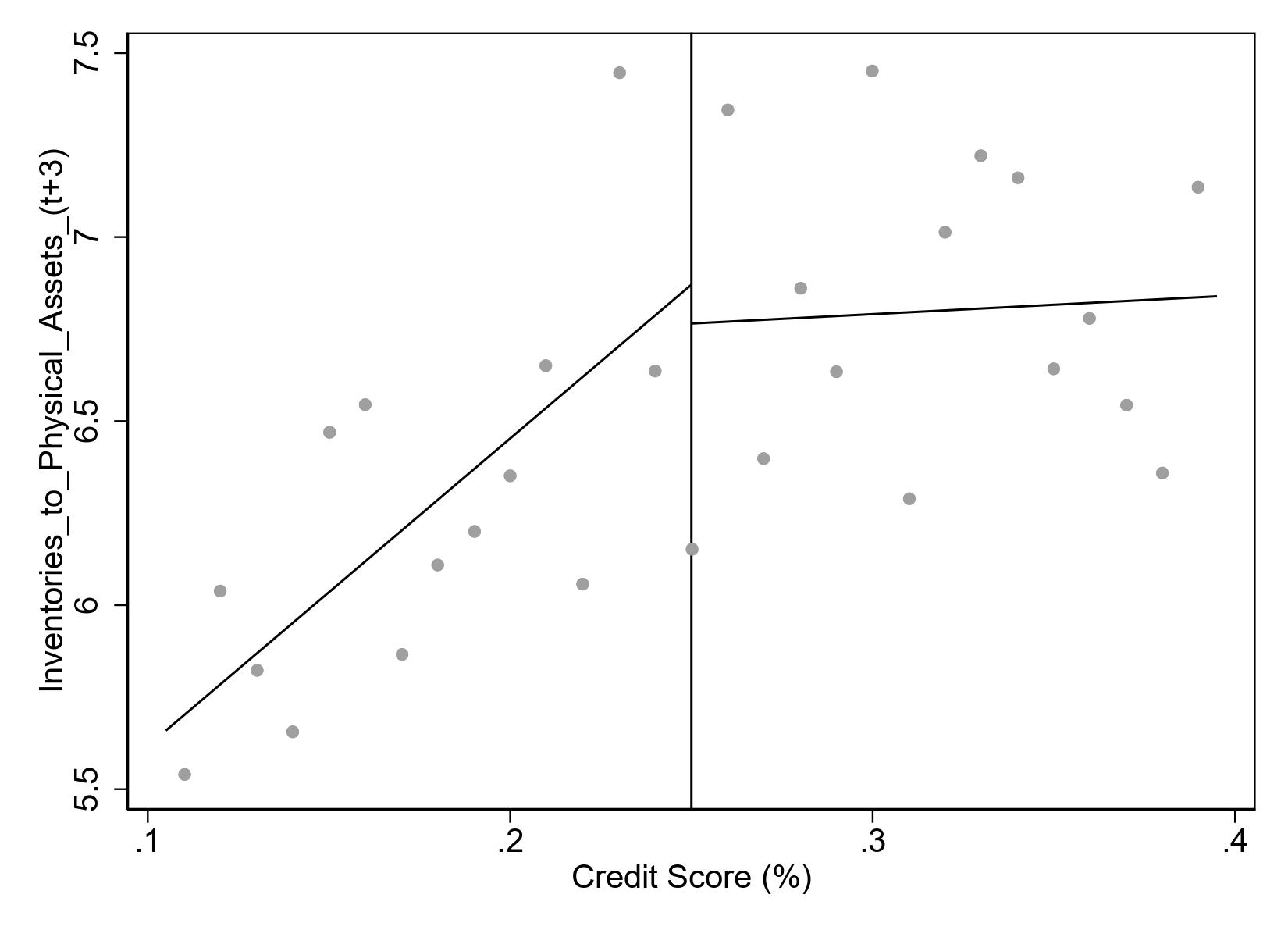

The Effect of Financial Constraints on Inventory Holdings

Standard finance theory predicts that more financially constrained firms hold larger inventories. I test this prediction using Swedish administrative data and data on credit scores. For identification, I exploit a discontinuity in the translation from continuous to discrete credit scores among Swedish firms. Firms that have a better credit score hold more inventories, both in the cross-section and around the cutoff. However, the regression discontinuity estimate is zero once we scale inventories by assets or sales. This suggests that inventories are determined by operational concerns rather than by financial concerns.

Works in Progress

The Value of Tenancy: Evidence on Housing, Labor Markets, and Family Formation

(with Viking Waldén)

We study the effect of housing, neighborhoods, and tenancy on socio-economic outcomes such as earnings and family formation. We exploit a feature of the Swedish housing market, where apartments are offered sequentially based on waiting time, as exogenous tenancy allocation. Becoming a tenant increases the probability of moving and induces moves to neighborhoods with different characteristics than they otherwise would have lived in. Receiving tenancy in poor neighborhoods induces moves to poorer neighborhoods than applicants otherwise would have lived in while receiving tenancy in rich neighborhoods makes applicants move to richer neighborhoods. Tenancy, however, leaves labor supply and family formation unaffected regardless of where the apartment is located.